Express Funded Accounttrading rules

Last updated: June 26, 2025. These rules apply to your activity in an Express Funded Account and work alongside the Express Funded Account Agreement. If there is ever a conflict between these rules and the agreement, the rules listed below will take precedence. Topstep reserves the right to update these rules at any time, with or without prior notice. It is your responsibility to review them regularly.

Rules and objectives at a glance

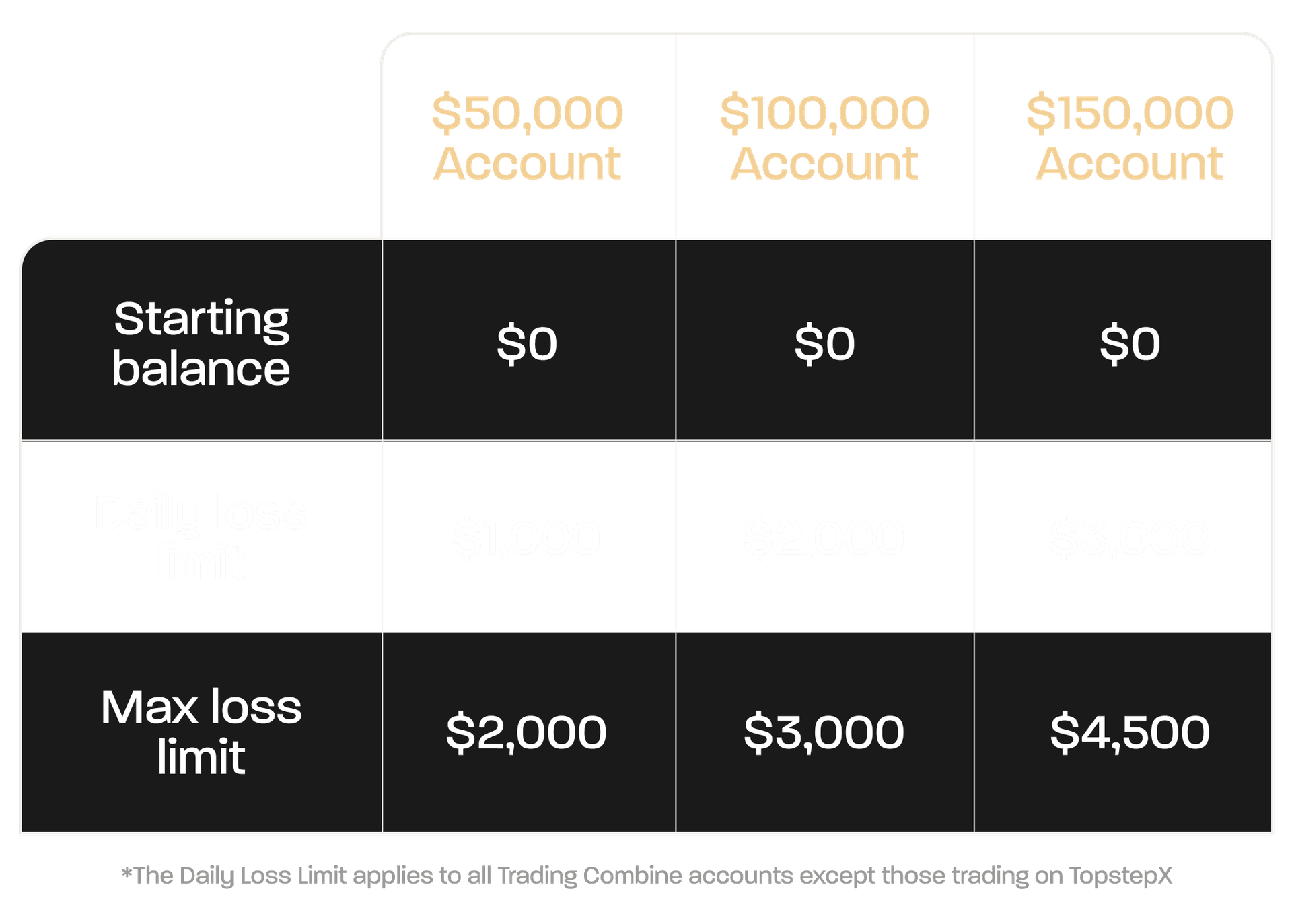

Each Express Funded Account starts with a $0 balance and includes a Max Loss Limit based on your Trading Combine® size: $2,000 for $50K accounts, $3,000 for $100K, and $4,500 for $150K. Your balance can go below $0 to accommodate your Max Loss Limit. If your Max Loss Limit balance increases to $0, your account will lock at $0. Accounts trading on platforms other than TopstepX are also subject to a Daily Loss Limit as outlined below.

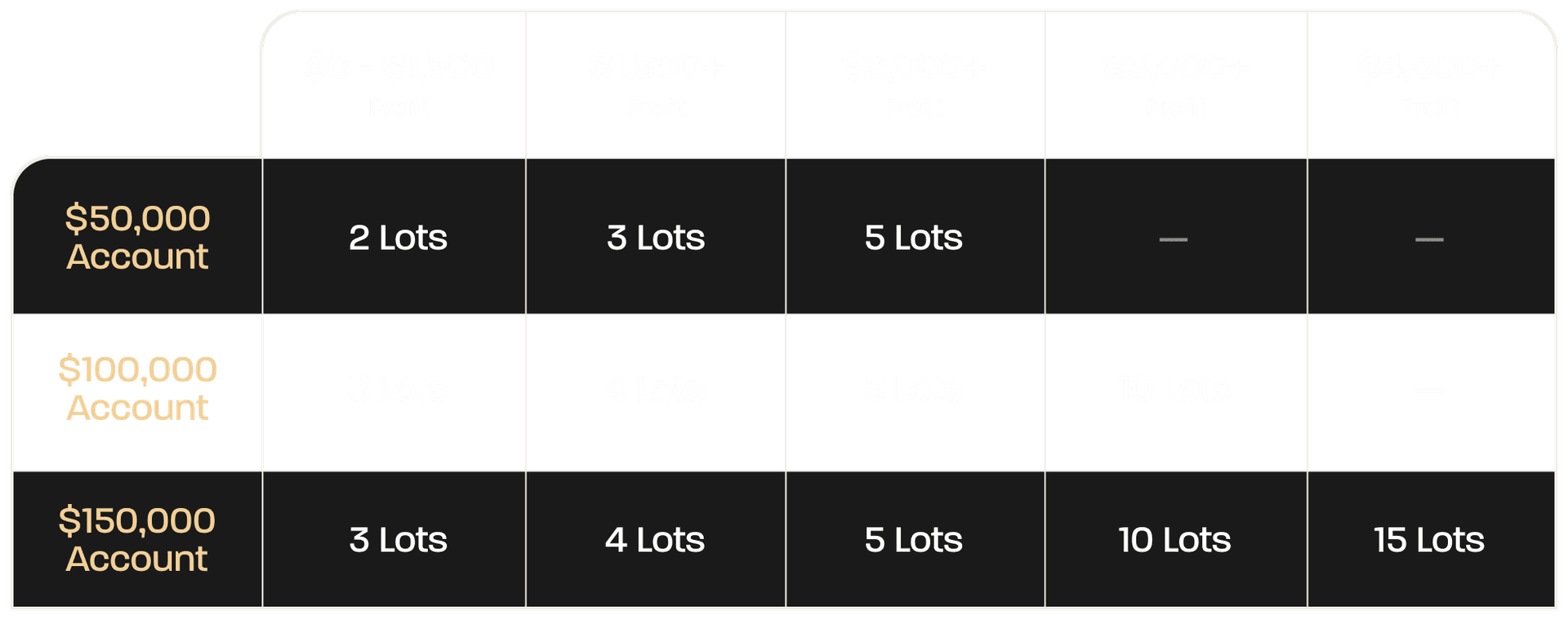

Scaling plan

Your contract limit is based on your account balance and follows the Scaling Plan. You’ll start at the lowest level of that plan with the ability to increase your position size based on your profits.

Stay funded. Know the rules.

You can have up to 5 active Express Funded Accounts at one time. This number may change depending on your activity or participation in other Topstep programs, such as the Focused Trader Program.

If your account ever drops to or below the Maximum Loss Limit, the account will be permanently closed. This limit is based on your highest end-of-day balance and does not go down if you lose money the next day.

Trader may not hit or exceed the Daily Loss Limit (as described here) while trading. The Daily Loss Limit is calculated intraday on both realized and unrealized net P&L, including commissions and fees. Hitting or exceeding the Daily Loss Limit will suspend Trader’s ability to trade for the remainder of the then current trading session, which resets for the next trading session (as set forth here).

Daily Loss Limits by Combine Size:

- $50K Combine = -$1,000

- $100K Combine = -$2,000

- $150K Combine = -$3,000

The Daily Loss Limit applies to all Express Funded Accounts except those trading on TopstepX

Normal electronic trading hours unless otherwise noted. All positions must be closed by 3:10 PM CT or by the product’s market close, whichever comes first. Abbreviated holiday hours can be found on Topstep’s website.

Rule adherence is determined solely by Topstep based on your account activity, not by the Trading Reports or platform metrics. These rules define how payouts are earned and processed, as well as outline the expectations for account use. By trading in an Express Funded Account, you’re agreeing to follow these rules and any updates we make.

Additional terms and info

You must follow CME holiday trading schedules. Topstep will attempt to send email reminders, but if you’ve unsubscribed, you will not receive them. If you would like to receive our email reminders, you can resubscribe to Topstep emails here.

When can I request a payout?

To be eligible for a payout:

- A “Benchmark Trading Day” is any trading day where markets are open and you earn at least $200 in Trading Profits by the market close.

- You must complete at least 5 Benchmark Trading Days before you can request a payout. This count resets after each payout.

Each payout:

- Can be up to 50% of your account’s reward balance, with a max of $5,000 per payout.

- Once a payout is approved, the payout amount is subtracted from your account balance.

How do profit splits work?

- The profit split is 90% to the trader and 10% to Topstep. When your total trading profits reach $10,000, you’ll earn a one-time $1,000 bonus. This bonus is one time per trader, not per account.

- After that, you get 90%, and Topstep gets 10%.

Any money in your Express account is always at risk and can be lost due to trading activity.

Your Express account includes simulated fees similar to what you’d pay in a live account. You can view the fee details here.

- If your Express Funded Account hits the Maximum Loss Limit, it will be permanently closed.

- If you choose to close your Express Funded Account and are eligible for a payout, you may receive up to 50% of your current Reward Balance, capped at $5,000. Any remaining balance will be forfeited.

- Topstep reserves the right to close your positions or disable your account at any time, with or without notice.

- You cannot receive an Express Funded Account if:

- You’ve been convicted of any felony or a misdemeanor involving dishonesty, fraud, or financial misconduct.

- You’ve been disciplined by the NFA or CFTC

- You have unresolved debt with a clearing firm

- You’ve used a fraudulent credit card or initiated a chargeback

If any of the above are found to be true, you will not get a refund for any fees paid. You’re expected to follow Topsteps Terms of Use and trade responsibly. You can read more about that here.

Back2Funded rules and guidelines

Back2Funded is available only for XFAs that meet all of the following:

- The XFA was originally earned through Topstep’s Trading Combine.

- The XFA was closed due to a rule violation before taking a payout.

- The XFA was lost on or after 9/3/2025.

- The XFA is on TopstepX in the new Topstep Dashboard.

Once a payout is taken from an XFA, it is no longer eligible for Back2Funded. The trader must be in good standing with no Focused Trader Plan restrictions or compliance concerns.

- Lose your XFA before your first payout.

- Within 7 days, decide if you want to go Back2Funded.

- Log in to the new Topstep Dashboard, select your account, and choose the Back2Funded option.

- Pay the reactivation fee for your XFA size (including sales tax).

- Your account will be reactivated and ready to trade at the start of the next trading session.

- Traders can have a maximum of 5 active or pending XFAs at one time.

- Once you pay the reactivation fee your account will be pending until the start of the next trading session.

- A Back2Funded-eligible XFA remains eligible for 7 calendar days before expiring.

- If you are at the 5 active or pending XFA limit, you cannot activate a new XFA

- If no action is taken within 7 days, the Back2Funded offer expires and will be automatically declined.

- Each XFA can be reactivated up to 2 times.

- Reactivations must be for the same size as the original XFA.

- Pricing is based on the original XFA size (plus applicable sales tax):

- $50K XFA: $499

- $100K XFA: $599

- $150K XFA: $729

- Each reactivation is purchased separately and is final and non-refundable.

You have seven calendar days from the time your XFA is closed to decide if you want to go Back2Funded. If no action is taken within 7 days, the Back2Funded offer expires and will be automatically declined.

- Back2Funded XFAs follow the same payout rules as standard XFAs.

- Traders may request a payout after five (5) winning days of $150 or more.

- Traders must be in good standing to participate in Back2Funded. Accounts with Focused Trader Plan (FTP) restrictions or those under review for fraud, manipulation, or compliance concerns are not eligible.

- Topstep reserves the right to modify or discontinue Back2Funded at any time.

- Back2Funded reactivations are final and non-refundable.

Back2Funded gives you the opportunity to pay for up to 2 reactivations if you lose your Express Funded Account (XFA) before your first payout. Each reactivation lets you keep the same account size and payout policy, giving you another chance to trade for a payout without starting over in the Trading Combine.

Looking to trade live?

Review the official Live Funded Account Rules to understand trading expectations, risk limits, payout policies, and everything you need to know before stepping into a Live Funded Account.