Live Funded Accounttrading rules

Last updated: February 9, 2026. These rules apply to all activity in your Live Funded Account and are part of the agreement you accepted with TopstepFunded LLC (“Topstep”). By using a Live Funded Account, you confirm that you understand and agree to follow all of these rules and any updates we make.

How these rules work

These rules work alongside your Live Funded Account Agreement. If there is ever a conflict between the two, these rules take precedence.

Topstep reserves the right to update these rules at any time, with or without notice.

You must follow all rules outlined here or in any other communication from Topstep.

Payout eligibility and the processing of payouts are governed by these rules and the terms of the Agreement.

By trading in your Live Funded Account following any update to these rules, you confirm that you have read, understand and agree to the most current version of these rules.

Review of activity

Topstep determines whether you are following the rules based on your actual trading activity. This is not based on what appears in your trading reports or on your trading platform.

Live Funded Account overview

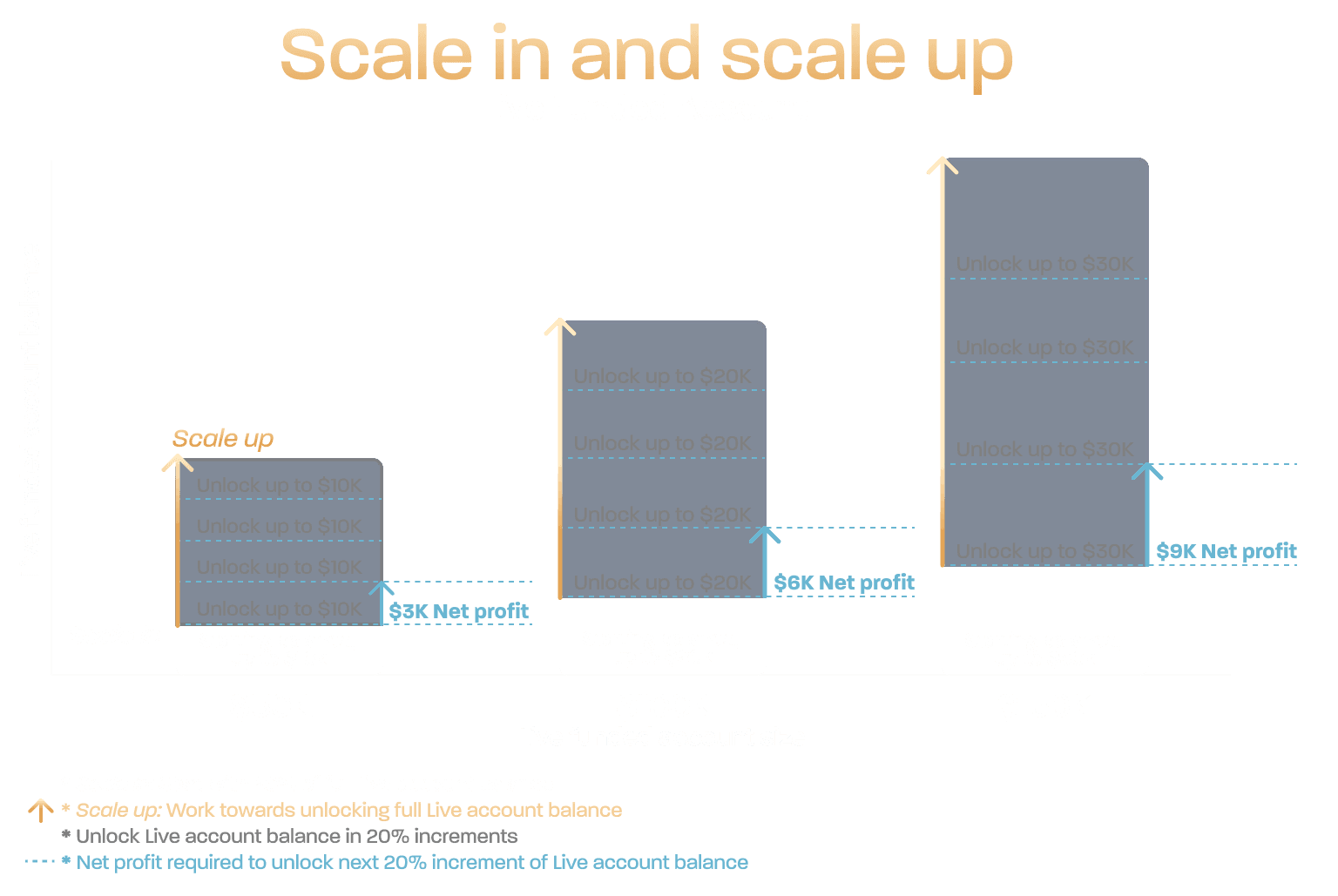

The Live Funded Account call up is designed to help traders transition successfully from simulated performance to live trading through a performance-based capital release structure.

When called up to Live:

- You begin with 20% of your eligible starting account balance available for trading

- The remaining balance becomes available as defined profit milestones are achieved

- Additional balance access is released as you achieve defined profit milestones

- Capital expansion is reviewed weekly

- Payout eligibility is separate from capital expansion

This structure allows traders to safely scale in while adjusting to live market conditions, working with the risk team, and maintaining a clear path to full account access.

Starting account balance

Your Live Funded Account includes two key values:

1. Live account size

Topstep allows traders to have one active Live Funded Account at a time. This step determines the account size of your Live Funded Account if you have multiple Express Funded Account sizes.

Your Live Funded Account size is based on the average account size of your active and eligible Express Funded Accounts.

- Only accounts with at least one payout are included

- The average is rounded up to the next tier of $50K, $100K, or $150K

- Your Live Funded Account maximum starting balance, rules, and limits are based on this capped size

2. Starting balance and unlock structure

Your actual Starting Balance is based on the combined total balance of your eligible Express Funded Accounts, up to your Live Account maximum starting balance.

Example: 2×$50K + $100K + $150K → $87.5K average → rounds to $100K Live size.

At Live activation:

- 20% of your combined total balance is available for trading

- The remaining balance unlocks in 20% increments through performance milestones

- Each unlock releases 20% of your available balance, until you reach your Live Account starting balance

Topstep may make discretionary exceptions for select traders based on performance and risk evaluation.

Balance expansion through performance

Additional available balance becomes accessible through net profit milestones achieved in the Live Funded Account. These milestones are the same profit targets achieved in the Trading Combine.

Additional rules:

- Balance expansion does not change payout eligibility rules

- Profits must be net since the last unlocked available balance event

- Expansion is reviewed no more than once per calendar week

- Your net profits will be measured after market close on Friday of each week

- Approved unlocked available balances are typically applied by the following Tuesday

Traders may continue unlocking balance access until 100% of the account Starting Balance has been made available for trading.

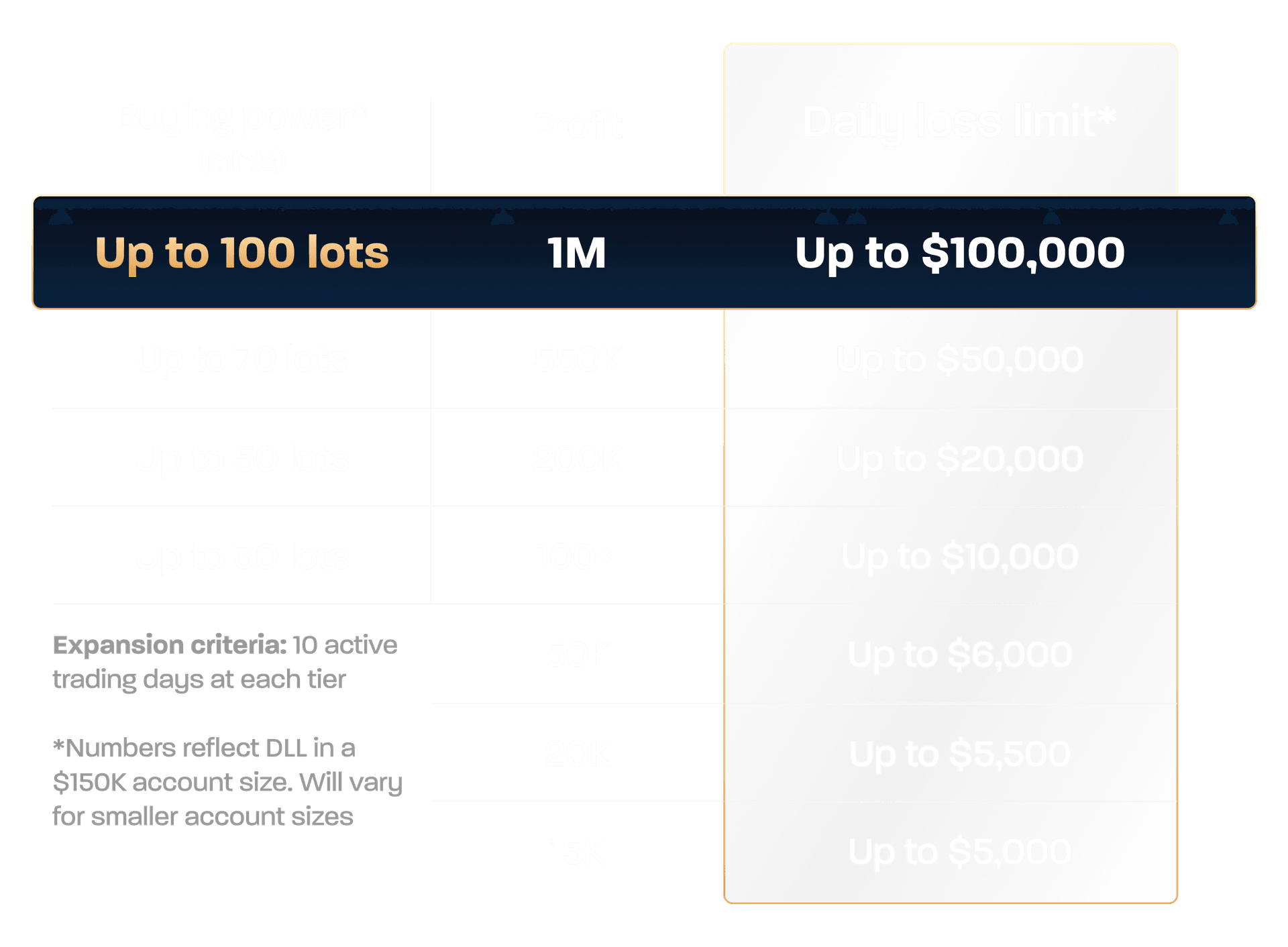

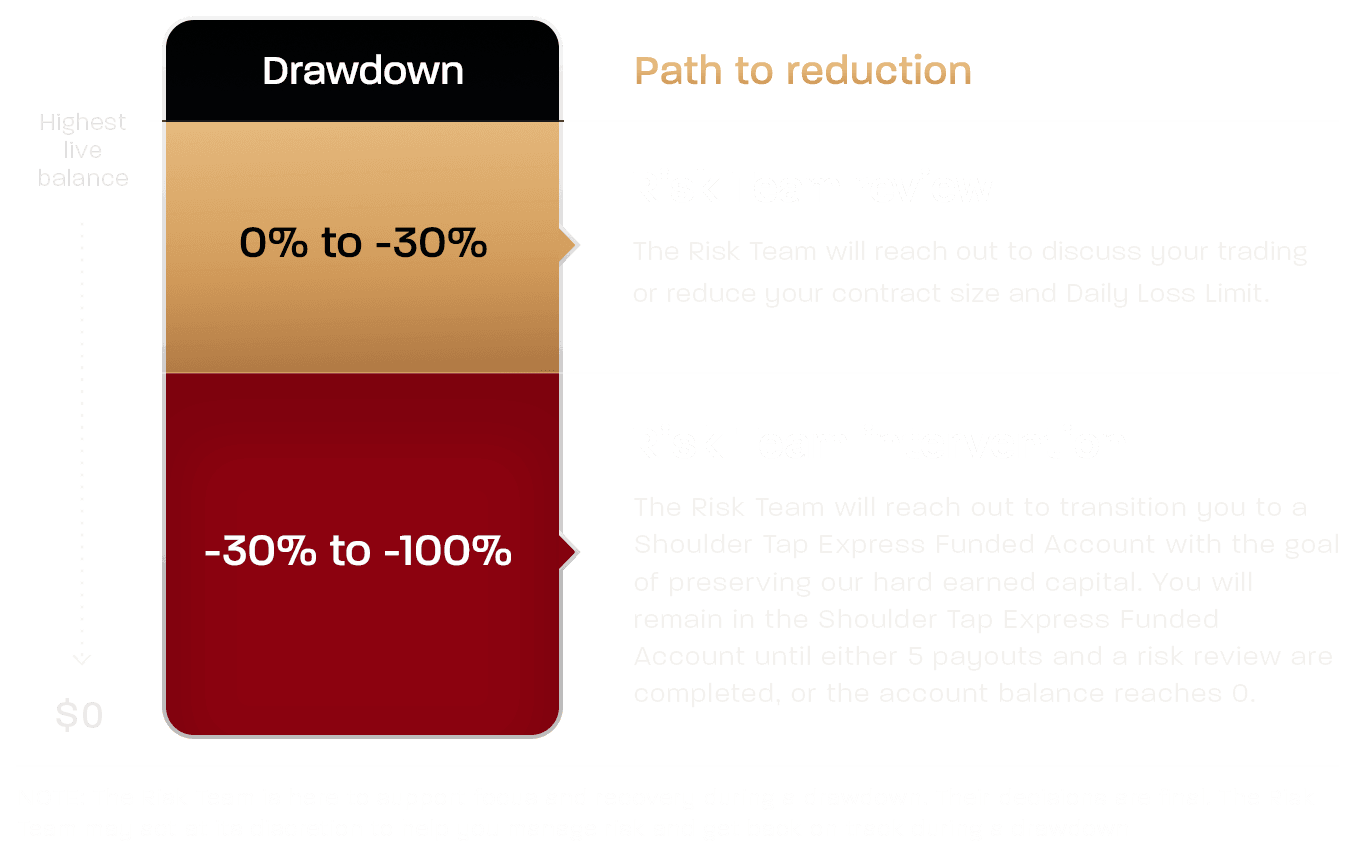

Dynamic live risk expansion

Your Daily Loss Limit adjusts with your account balance, so the more you profit, the more room you’ll have to trade. Once you reach $100,000, you can contact the Trade Desk to request higher contract limits. If your account enters a drawdown, the Path to Reduction helps manage risk by tightening limits until you recover.

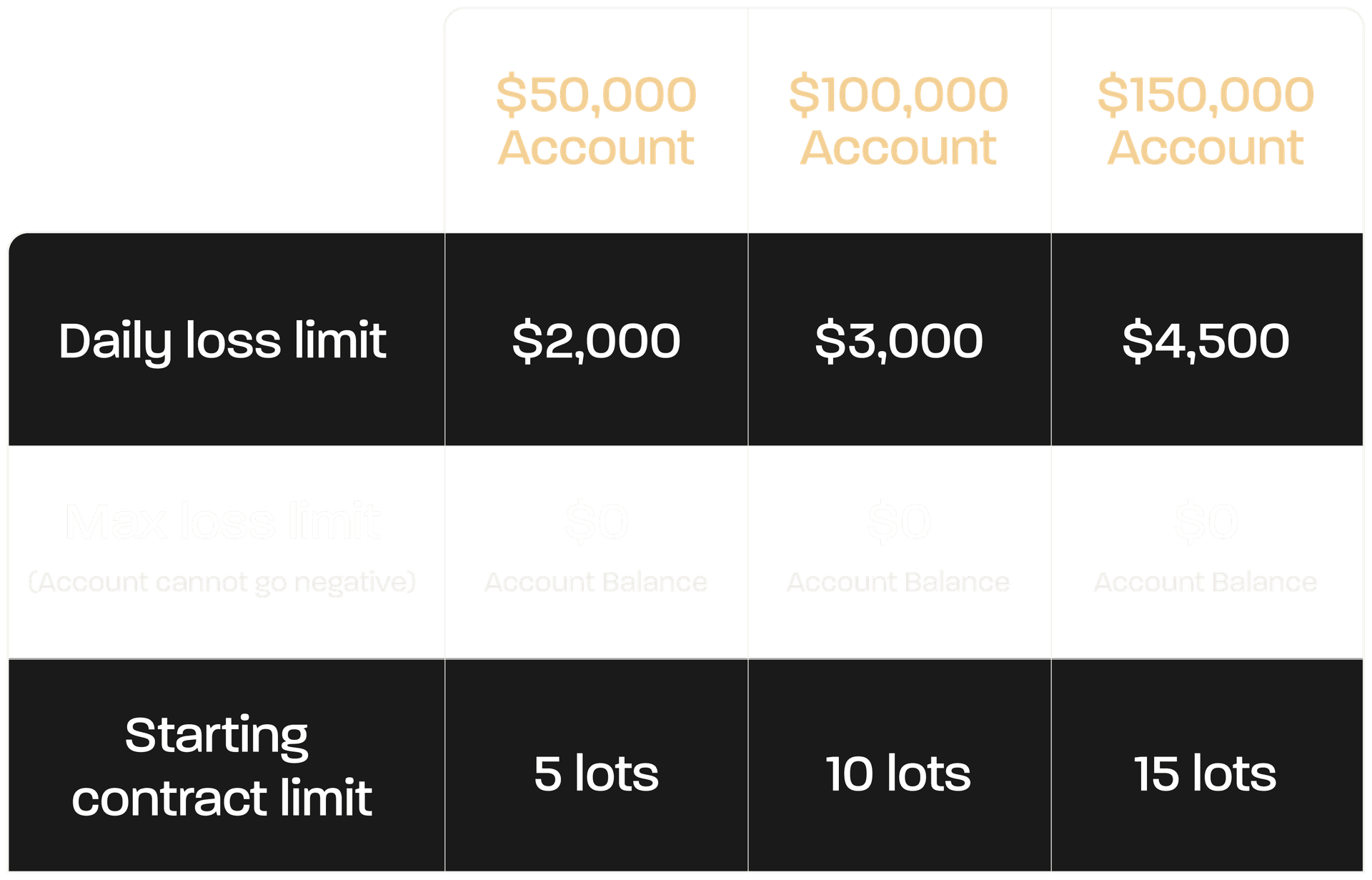

Daily loss limit

Your Daily Loss Limit and starting contract limits are set by your Live account size. If the Daily Loss Limit is reached, positions are flattened, orders are canceled, and trading pauses until the next session. This pause is not a rule violation.

Your Daily Loss Limit continues to scale up or down with your available balance.

If the Daily Loss Limit is reached:

- Positions are flattened

- Orders are canceled

- Trading is paused until the next trading session

This pause is not a rule violation.

*If the account is auto liquidated with a balance less than $500 the trader forfeits the account.

Scaling Plan

The Scaling Plan (as described here) is based on the Account Balance. Initially, Trader’s purchasing power will be set to the minimum tier of the Scaling Plan. As Trader gains experience, Trader may request an increase. Trader will initially be required to scale Trader’s contract size in order to sustain a possible drawdown and to support Trader’s success in the Live Funded Account. The lot size will increase or decrease according to the graph below, as the Account Balance increases or decreases.

| $0-$1,500 Profit | $1,500+ Profit | $2,000+ Profit | $3,000+ Profit | $4,500+ Profit | |

| $50,000 Account | 2 Lots | 3 Lots | 5 Lots | - | - |

| $100,000 Account | 3 Lots | 4 Lots | 5 Lots | 10 Lots | - |

| $150,000 Account | 3 Lots | 4 Lots | 5 Lots | 10 Lots | 15 Lots |

Risk management

The Path to Reduction is designed to help protect your Live Funded Account during periods of drawdown. If your account balance takes a large drop from its highest balance, our Risk Team will review performance and may reach out with a Shoulder Tap.

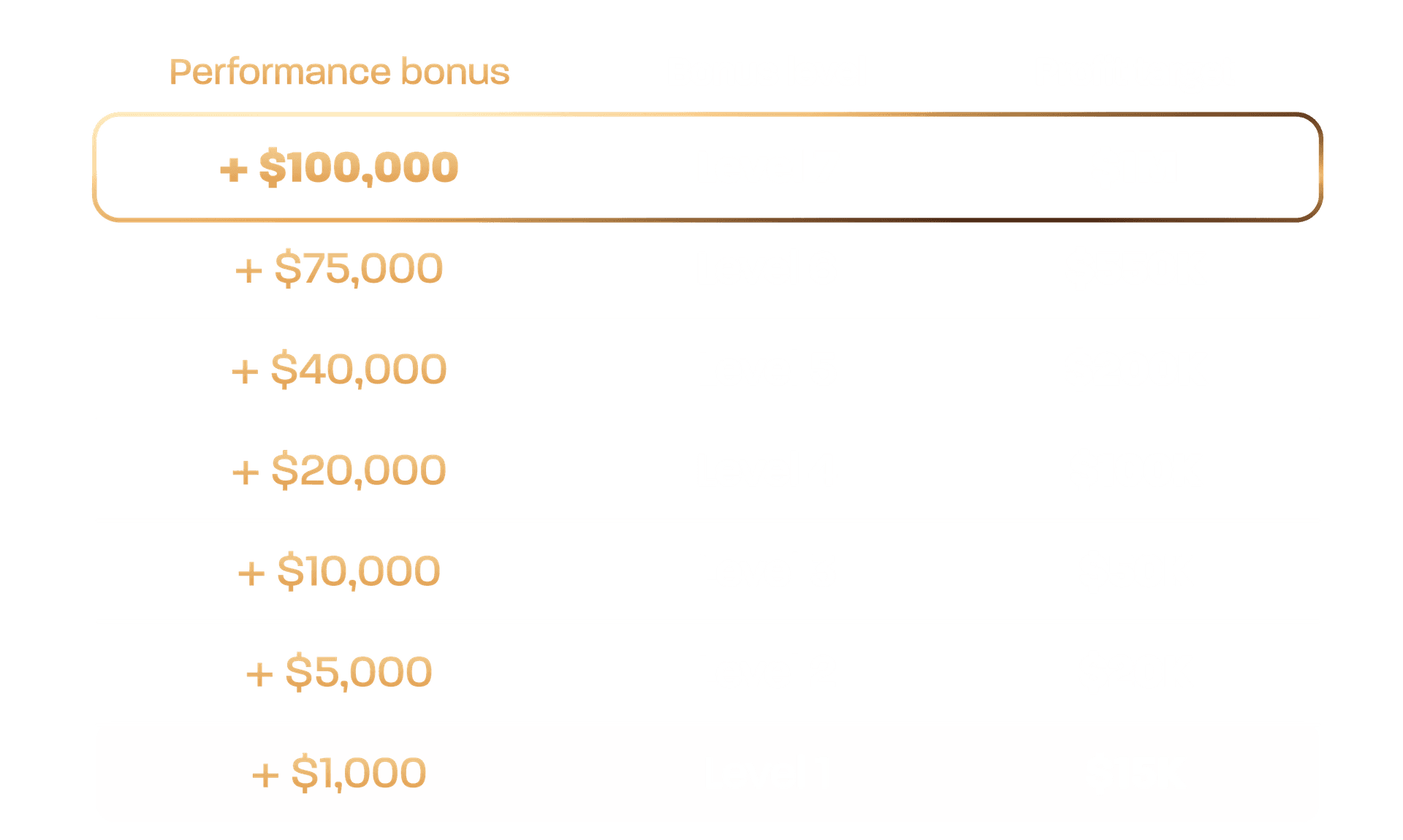

Performance bonuses

The Topstep Live Performance Bonus is an incentive program that allows consistently profitable Live Funded traders to earn over $250,000 in cash bonuses. Traders work their way up the bonus ladder one level at a time, unlocking a new cash bonus each calendar month they hit a qualifying profit target. This bonus is designed to reward consistency, discipline, and long-term growth.

Performance bonuses are independent of payouts and balance expansion. You can find all the details here.

Stay live. Know the rules.

Trader may not hit or exceed the Daily Loss Limit (as described here) while trading. The Daily Loss Limit is calculated intraday on both realized and unrealized net P&L (meaning, below your start of day balance), including commissions and fees. Hitting or exceeding the Daily Loss Limit will suspend Trader’s ability to trade for the remainder of the then current trading session, which resets for the next trading session (as set forth here).

Trader may not hit or exceed the Maximum Loss Limit (as described here). Currently, your Maximum Loss Limit is $0. For the remainder of your Live Funded Account, you will need to make sure your account balance stays above $0 (positive).

*If the account is auto liquidated with a balance less than $500 the trader forfeits the account.

Products may be traded during normal electronic trading hours unless otherwise indicated. Abbreviated holiday hours can be found on Topstep’s website. All positions MUST be closed prior to 3:10 PM CT or prior to the market close of that product, whichever is sooner.

Rule Violations and What Happens

- If your account is below your Starting Balance when you break a rule, your Live Funded Account will be closed immediately, without notice.

- If your account is above your Starting Balance when you break a rule, your Live Funded Account will be closed immediately. (Profits will be split between you and Topstep as described in your Agreement.)

Refer to the full Agreement and the complete Live Trading Rules for full details.

Additional terms and info

The Daily Loss Limit is a protective threshold designed to help you manage risk. If your Net P&L reaches or exceeds this limit during the trading day (defined as 5:00 PM CT to 3:10 PM CT), your account will enter a soft breach.

Here’s what that means:

- Your open positions will be closed (flattened).

- Any pending orders will be canceled.

- You’ll be locked out from placing new trades until the next trading day begins (5:00 PM CT).

This lockout is not a rule violation. It’s a pause meant to protect your account and give you time to regroup.

To help you stay within your limits, we’ll also automatically flatten all positions about ten seconds before the trading session ends (3:10 PM CT), as determined by Topstep.

Holiday hours can impact your trading schedule and data fees. Here’s what you need to know:

- Holiday Flattening Requirements: You must close all trades during the holiday hours outlined in our Holiday Schedule. These requirements may differ from standard trading days.

- Data Fees and Holidays: Data fees are not prorated for months with holiday trading restrictions. If you plan not to trade for the entire month, including holiday hours, and want to avoid being charged a data fee, you must email our team before the 26th of the previous month to request removal.

- Important: We do our best to notify you of holiday trading changes, but if you’ve unsubscribed from Topstep emails, you won’t receive alerts. To stay in the loop, please resubscribe to emails here.

Payout Eligibility and Limitations

A “Benchmark Trading Day” is a market day where you actively trade and earn at least $150 in Trading Profits (adjusted for holidays). You will not receive credit toward Live Funded Account Benchmark Trading Days for any Benchmark Trading Days earned in an Express Funded Account.

Payout eligibility in the Live Funded Account remains separate from balance expansion.

To be eligible for a payout:

- You must have at least 5 Benchmark Trading Days since either your Live Funded Account Effective Date or your last payout, whichever is later.

- Your initial and following payouts are limited to 50% of your share of Trading Profits until you reach 30 Benchmark Trading Days in your Live Funded Account.

- Once you have 30 Benchmark Trading Days in your Live Funded Account, you may:

- Request 100% of your share of Trading Profits.

- Request one payout per business day, provided other rules are followed.

- To comply with exchange and regulatory guidance, Topstep will monitor your account to ensure total payouts do not exceed 90% of the Starting Balance plus net Trading Profits. If needed, deductions may be made to stay within that limit.

Topstep will monitor your account to ensure total payouts do not exceed 90% of the Starting Balance plus net Trading Profits. If needed, deductions may be made to stay within that limit.

- You keep up to 90% of the profits.

- Unwithdrawn profits remain at risk of loss.

Topstep reviews every account and payout to ensure total payouts never exceed 90% of your Starting Balance plus all net trading profits consistent with exchange and regulatory requirements for prop trading. We may withhold or adjust payout amounts to comply with this limit.

- If eligible, you may request a payout through the Client Portal.

- Payouts can beare sent via Aeropay Wise, ACH, or wire transfer depending on your location and situation.

- Fees vary by payout method, and a minimum payout amount must be met before a request can be submitted. may apply, especially for rejected payouts due to incorrect banking info.

- Rejected payouts due to incorrect banking information may also incur additional fees.

For full details, refer to the Payout Information Form.

Topstep pays for one market data feed. You are responsible for paying monthly data fees for any additional data feeds, including those charged by the CME Group.

These fees:

- Are billed around the 26th of each month to cover the upcoming month.

- Are not prorated based on when you begin trading.

- Must be paid in full. Failure to do so will result in the immediate suspension of your Live Funded Account.

- Vary depending on your selected trading platform and brokerage.

⚠️ Note: Data feeds from outside providers are not supported in Live Funded Accounts.

Your Live Funded Account is subject to commissions and fees charged per round-turn trade.

These:

- Reflect actual rates from Topstep’s brokerage partners and exchange costs.

- May change at any time and are effective immediately upon update.

- Are deducted from your Account Balance and impact your P&L calculations.

💡 NFA and exchange fees post to your account around 2:00 AM CT the next day. If those updates cause a rule violation (e.g., drop your balance below your limit), your Live Funded Account will be closed.

Topstep currently covers live market data fees for the CME exchange only. This does not include CBOT, COMEX, or NYMEX data. Traders are responsible for any additional exchange fees.

See platform-specific commission details here.

By using a Live Funded Account, you acknowledge and agree to the following:

- Protective Stops Required: You must place a protective stop order on every open position.

- Account Inactivity: If no trades are placed within a 90-day period, your Live Funded Account will be considered abandoned and permanently closed. Any remaining funds will be allocated according to your Agreement.

- Availability: You must be reachable at the phone number you provided to Topstep at all times while actively trading.

- Account Control: Topstep reserves the right to liquidate any open positions and suspend or close your Live Funded Account, temporarily or permanently, with or without notice.

- Eligibility Requirements: You are not eligible for a Live Funded Account if:

- You have been convicted of any felony or a misdemeanor involving dishonesty, fraud, or financial misconduct;

- You have been disciplined by the NFA or CFTC;

- You have outstanding debts with a clearing firm.

- You have used a fraudulent credit card or initiated a chargeback with your card issuer.

- If you’re found to be ineligible, no refunds will be issued for Trading Combine® fees.

- Responsible Trading: You are expected to follow Topstep’s Responsible Trading Guidelines, which outline the standards and conduct expected of all Live traders found here.

The Path to Reduction is a tiered system that helps manage risk in a Live Funded Account (LFA) during a drawdown. When your account experiences significant losses from your starting balance, our Risk Team will monitor your performance and eventually reach out for a Shoulder Tap.

What is a Shoulder Tap?

The term comes from the trading pits, where risk managers would literally tap a trader on the shoulder during a drawdown to review what was happening and help them refocus.

At Topstep, a shoulder tap means one of our Risk Managers may reach out when your Live Funded Account experiences a significant drawdown. They’ll look at your recent trading behavior, talk through what’s happening, and, if needed, adjust your contract size or Daily Loss Limit to help you focus and get back on track.

Payouts do not count as drawdown and do not impact your risk tier. Drawdown is based solely on losses from your LFA starting balance.

Important:

Reckless or undisciplined trading in a Live Funded Account may result in the forfeiture of Live capital.

Trading in an Express Funded Account?

Make sure you’re familiar with the rules and objectives of the Express Funded Account before progressing to a Live Funded Account.